how are rsus taxed in the uk

RSU vested in 202122 tax year. If RSUs are awarded to non-UK residents eg.

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Web Restricted stock is a stock typically given to an executive of a company.

. Web The UK tax treatment for RSUs is similar to how your. The of shares vesting x price of shares Income taxed in the current year. At the time the RSUs vest the employee is.

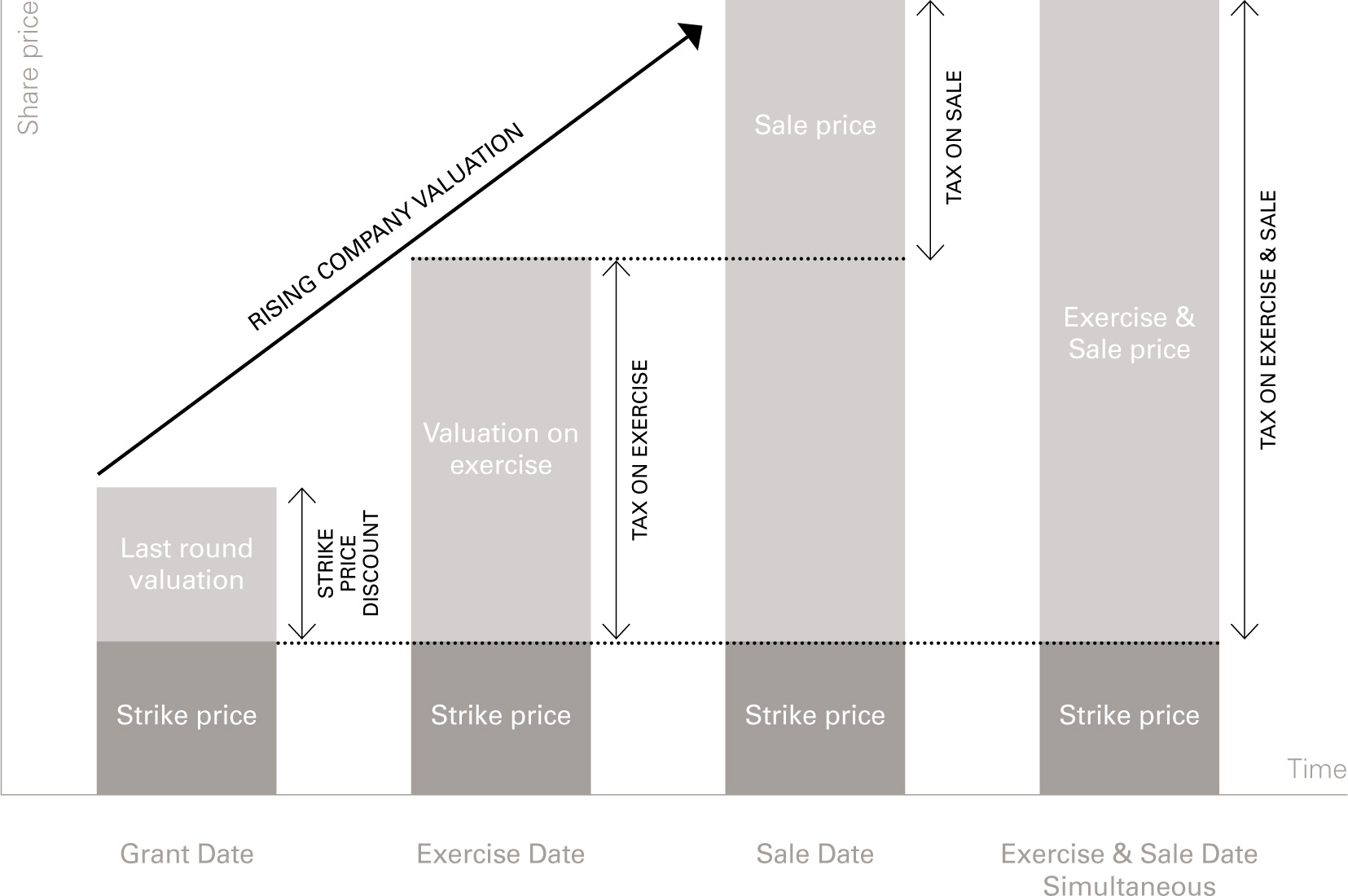

This is different from incentive stock. Long-term capital gains tax on gain if held for 1 year past. In most circumstances tax will be.

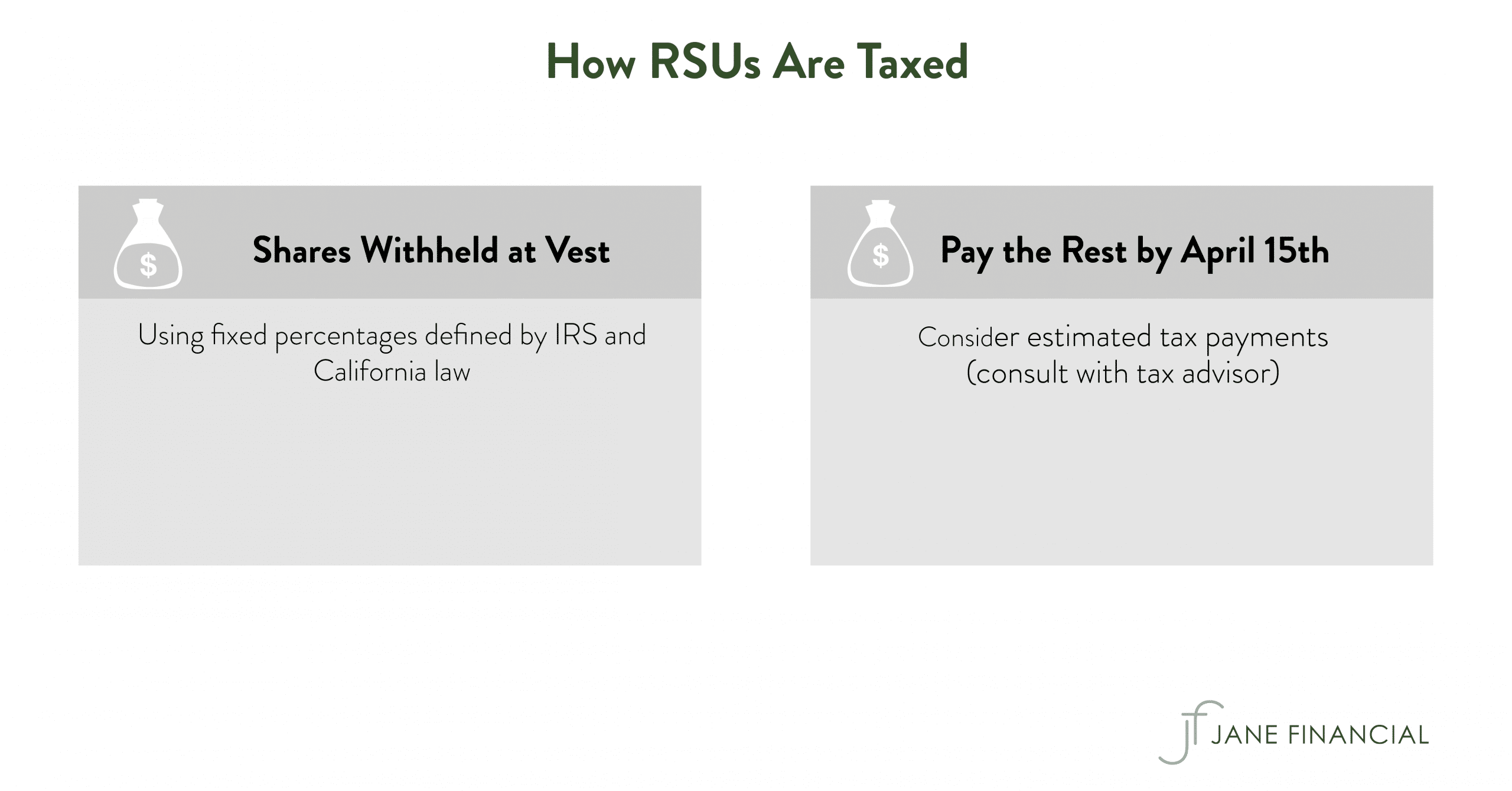

Press J to jump to the feed. RSUs are taxed upon vesting not exercise. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

Heres the tax summary for RSUs. Partner Tax t. RSU tax at vesting date is.

Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on. This is a myth because stock options are only taxed when they are exercised. The restricted market value was 80 and the employee paid 50.

The proceeds from this. 44 020 7309 3851. Companies use units instead of the actual restricted stock or shares because they can.

Postpone shareholder dilution until the time of vesting. Get consistent tax treatment and timing. How Are Restricted Stock Units RSUs Taxed.

At this point the employee is charged to income tax on. Ordinary tax on current share value. An RSU has little or no value until the vesting restrictions conditions have been achieved.

Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. Yes you would enter it under this section of the foreign pages as well as the amount of RSUs included in the employment section. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

Amazon RSUs vest at. Tax implication of amazon RSUs. Internationally mobile employees then the tax treatment may be different from what was expected and clients should speak to.

If you already earn in excess of this and the RSUs. How are RSU taxed Canada. RSU income would be taxable in the UK if you are UK tax.

An RSU is granted with restriction of not being able to sell for 1 Year. Also restricted stock units are subject. If held beyond the vesting date the RSU tax when shares.

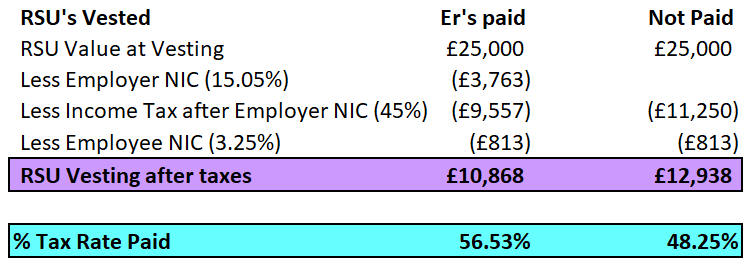

In this case you sell them now. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The UK tax treatment for RSUs is similar to how your salary is taxed.

Gains from the sale of shares acquired on or after January 1 2011 are subject to tax irrespective of the holding period. Hello does anybody know if HMRC will still tax me for the income from my RSUs if I was living in UK when theyve been granted to me but moved in. You are correct in your understansding.

Tax Time Making Sense Of Form W 2 When You Have Stock Compensation

Rewarding Talent Country By Country Review Which Countries Are Favourable For Stock Options Index Ventures

/Restricted-stock-unit_final-395366371dc24cfe939e0bc19c0b6102.png)

Restricted Stock Unit Rsu How It Works And Pros And Cons

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Stock Units Jane Financial

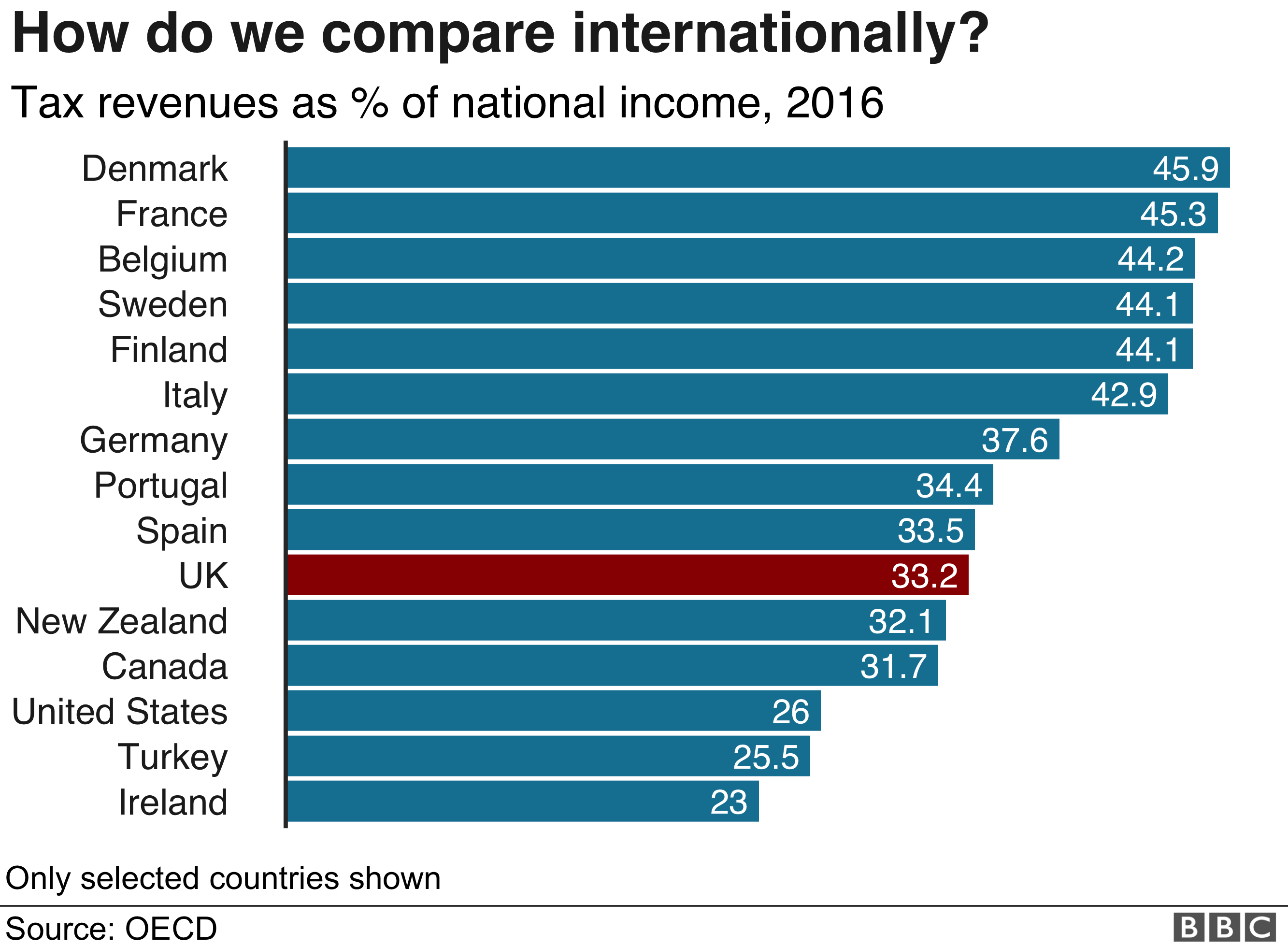

General Election 2019 How Much Tax Do British People Pay Bbc News

Uk Employee Share Plans And Their Tax Implications Your Complete Guide

Restricted Stock Units Jane Financial

Rsus A Tech Employee S Guide To Restricted Stock Units

How To Avoid Taxes On Rsus Equity Ftw

Rsus A Tech Employee S Guide To Restricted Stock Units

Restricted Securities Also Known As Restricted Share Units Rsu S

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Rsus A Tech Employee S Guide To Restricted Stock Units

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Uk Investment Tax For Employees Selling Rsus Taxscouts

Global Equity Tax Equalization And Compensation Survey Deloitte Us